Offer Details

About Axis ASAP Digital Savings Account –

- Open your Digital Bank Account from anywhere, anytime saving all the hassle of going to an actual bank

- Get instant E-Debit card as soon as you open your bank account, you can also opt for a Physical Debit Card whenever you want

- Axis Debit offers you great cashbacks and offers giving an edge over the others

- It also gives access to all the 250+ online services that Axis bank provides

- You get secured money transfer facilities such as UPI, NEFT, IMPS and RTGS

- Get Cashback whenever you make a purchase on your favourite retailers like Amazon, Flipkart & more via Grab Deal (their own cashback site) using Axis Visa Debit Card

Axis Visa E-Debit Card Features

- Cardless withdrawal enabled

- Daily purchase limit: Rs 1,00,000

- Get 2000 Edge Rewards on annual spends above Rs 1,00,000 as milestone benefit

Axis Visa Physical Debit Card Features

- Daily ATM Limit: Rs 50,000

- Daily purchase limit: Rs 5,00,000

- Get Rs 500 Voucher on your First Transaction within 30 days

Benefits of Axis Visa E-Debit Card

- Flat 10% cashback on Amazon & Flipkart (via Grab Deals)

- Flat 1% cashback on all other online spends (Upto Rs 200 per month)

- Flat 20% cashback on Zomato & Tata1mg (via Grab Deals)

- Upto 20% off on 4000+ restaurants in India (via Tap and Pay)

- Buy 1 Get 1 Free movie ticket every month on BookmyShow if booked via E-Debit Card (Upto Rs 200 per month)

- Upto Rs 1,000 monthly cashback for spends on Grab Deals

- Conditions are applicable on all Cashback offers and redemptions

Benefits of Axis Visa Physical Card

- Flat 10% cashback on Amazon & Flipkart (via Grab Deals)

- Flat 20% cashback on Zomato & Tata1mg (via Grab Deals)

- Upto 35% cashback on 50+ major brands when you shop via Grab Deals

- Earn Edge rewards at high rate for transactions online and offline

- 10X for Travel booking, 5X on Electronic purchase, 3X on Online food delivery, 2X on Clothing stores

- Get Personal Accident cover for Rs 5,00,000; Air Accident Cover for Rs 1 crore; Loss of Baggage Upto 500 USD; Purchase Protection for Rs 50,000

- Upto 20% off at 4000+ partner restaurants in India

- Monthly cashback Upto Rs 1,000 for spends on Grab Deals

- Conditions are applicable on all Cashback offers and redemptions

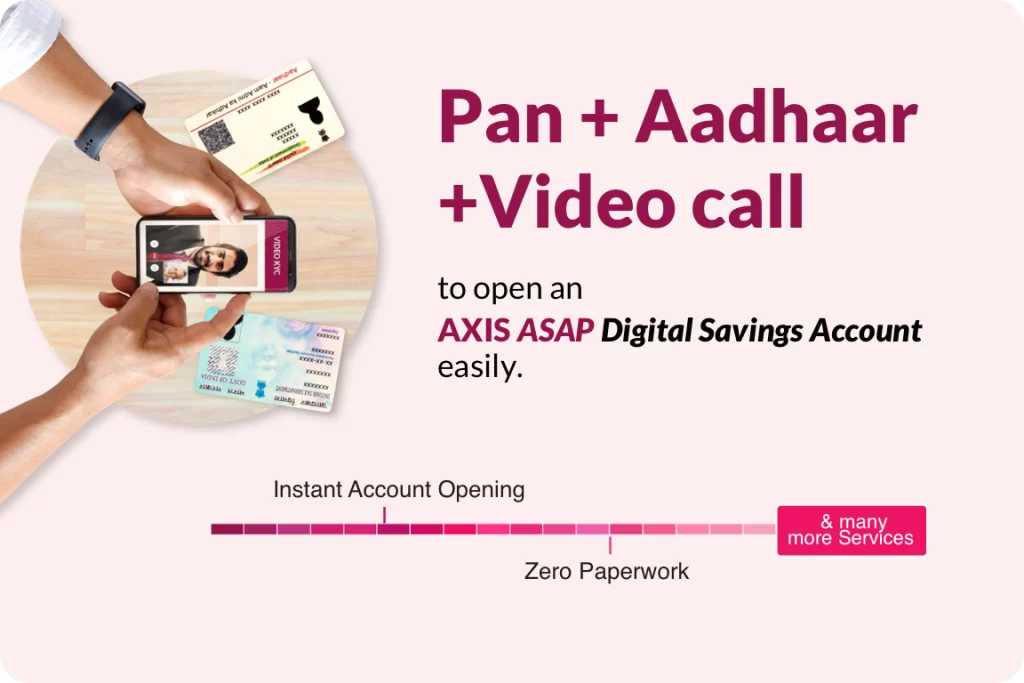

How to Open Axis ASAP Digital Savings Account

- Step 1: Select the type of Axis ASAP Digital Savings Account you’d like to open and verify yourself using your PAN, Aadhaar and mobile number

- Step 2: Key in your personal details

- Step 3: Complete verification via Video KYC

- Step 4: Fund your account and confirm your name to be published on debit cards

Eligibility Criteria & Documents Needed –

- You should be an Indian citizen

- Original PAN and Aadhaar number

- Aadhaar must be linked to a valid mobile number

- Must be at least 18 years of age

- You should be applying for account opening from India

- The Desktop/Laptop or Mobile Device with which you are opening an account should be enabled with a camera and microphone facility for the Video KYC process